Tax relief available

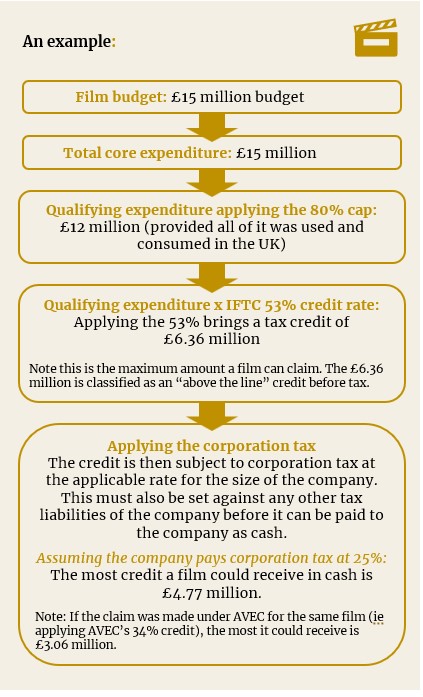

The new UK independent film tax credit (IFTC) rate will be 53% of qualifying expenditure. It will be calculated in the same way as AVEC, ie only on the costs of production activities and not ancillary ones such as finance, marketing and distribution. Qualifying expenditure is capped at 80% of a film’s total core expenditure, or on the amount of UK core expenditure. The maximum credit a film can receive is £6.36million.

The IFTC (like AVEC) is an above-the-line tax credit on qualifying expenditure. It is taxable at the main rate of corporation tax – currently 25%. At that rate, the maximum cash repayable element would be £4.77million.

This means the IFTC rate nets down to 39.75% after the corporation tax is deducted. However, this is still significantly higher than the AVEC rate for films, which nets down to 25.5%.

Exclusions

- TV programmes (only productions with the intention of a theatrical release will qualify).

- If claiming the IFTC, separate claims for the visual effects and animation uplifts cannot be made.

Qualification criteria

- Film production budgets (excluding financing, marketing, and distribution costs) must not exceed £ 23.5 million. That said, the ITFC can only be claimed on £15 million of qualifying costs.

- Films must pass a new British Film Industry (BFI) test and meet at least one of the following: Have a UK writer (national or resident), or a UK director (national or resident), or be certified as an official UK co-production.

- The film will need to be certified as a low-budget film by the BFI. It must also demonstrate the intention of a ‘theatrical release’.

- At least 10% of a production’s core expenditure must be used or consumed in the UK.

- Qualifying productions must have started principal photography on or after 1 April 2024 and only expenditure incurred after 1 April 2024 can be claimed.

To qualify, and if there is more than one director or scriptwriter, the ‘lead’ scriptwriter or director is defined as someone whose contribution to the film is equal to or greater than the contribution by any other person employed in that role.

The claims process – key dates and what to expect

Claims can be submitted to HMRC from 1 April 2025 onwards for expenditure incurred from 1 April 2024, but only if the film began principal photography after 1 April 2024.

As part of the application for a Certificate of a Low Budget Film, information must be provided to the BFI in addition to that required for the standard Cultural Test.

This includes:

- The total cost of the film by category (cost report), broken down into core expenditure and non-core expenditure.

- Details of lead UK scriptwriter or director – name, role, explanation as to why they are the lead scriptwriter or director, employment contract for that person. If there are multiple directors or scriptwriters, the contract of employment for all directors or scriptwriters. For scriptwriters, also the Chain of Title showing that the rights sit with the production company.

- A statutory declaration confirming the veracity of the application

- An accountant’s report verifying the core and non-core spend breakdown and that the person in the creative connection condition satisfied the citizen/ordinary resident requirement.

In submitting claims, companies will be expected to submit:

- an additional information form for the relevant period

- their BFI certificate.

The claim will be submitted as part of the Company Tax Return. If all necessary documentation has been provided, claims will be checked and paid.

If budgets run over £23.5m

While the budget condition has been expanded to a maximum core spend of £23.5m, the IFTC is still capped at 80% of £15m. Beyond budgets of £23.5m, productions are better off applying for the standard AVEC relief.

Can we help?

We are currently helping film, TV, children’s TV and animation companies understand the impact of IFTC and AVEC on their productions and assess when to migrate across to the new system. Our track-record in enabling businesses in the broadcast industry successfully claim the relevant tax reliefs, means we are well-placed to answer your questions.

Contact one of our team of specialists on t: +44 (0)20 7312 0000 or e: Steve Joberns, Gurvir Cheema, Lauren Gilman