In this article…

- Income tax

- Dividend income

- National insurance

- Capital gains tax

- Inheritance tax

- Individual savings accounts (ISAs)

- Enterprise Investment Scheme (EIS) and other investments

- Non-doms and residency

- Further help

Income Tax

With thresholds on hold, be mindful that salary increases and bonuses given this year may mean you move into a higher tax bracket. Take particular care if your income moves into the £100,000 to £125,140 range, as your personal allowance is reduced by £1 for every £2 over £100,000.

If your income falls just above one of the tax thresholds, you may want to consider the following strategies to reduce your taxable income.

| Taxable income | 2024/25 & 2025/26 income tax rate |

| Up to £37,700 | 20% |

| £37,701 to £125,140 | 40% |

| Over £125,140 | 45% |

If you are married or in a civil partnership and one of you is not using all your personal allowance (still £12,570), while the other is a basic rate taxpayer, you should use the marriage allowance to transfer £1,260 of the allowance and save £252 tax.

Get tax relief in 2024/25 for gift aid donations made by 5 April 2025 or, by election, for cash gift aid made by 31 January 2026 before filing your 2024/25 tax return.

Tax relief is also available on gifts of quoted shares and land to charity, but only for the year the gift is made. There is no capital gains tax or inheritance tax liability on such gifts.

The personal savings allowance of £1,000 for basic rate taxpayers and £500 for higher rate taxpayers means interest up to these levels is tax-free. Spouses/civil partners get their own allowances so consider splitting your savings to optimise tax benefits. If your non-savings income is less than £17,570 per year, you’re allowed to earn up to £5,000 interest tax-free.

Pension contributions up to £60,000 qualify for tax relief. This is reduced to 100% of your income if you earn less than that or is tapered (to a minimum of £10,000) if your adjusted income is over £260,000. The limit is also £10,000 if you have already started drawing a defined contribution pension.

For anyone with income between £100,000 and £125,140, pension contributions can provide tax relief at an effective rate of 60%. If you have held a pension scheme in previous years and didn’t fully use your allowance in the previous three tax years, any unused allowance is available this year. Contributions made by your employer or your company also count towards your allowance.

Paying into a pension scheme will reduce your taxable income and may preserve personal allowances, savings allowances and also reduce the high income child benefit charge.

Dividend Income

The £500 tax-free allowance for all individuals and dividend tax rates are unchanged from 2024/25 to 2025/26:

| Basic rate taxpayers | 8.75% |

| Higher rate taxpayers | 33.75% |

| Additional rate taxpayers | 39.35% |

National Insurance

From 6 April 2024, class 2 was made voluntary for the self- employed, and class 4 reduced from 9% to 8% on all earnings between £12,570 and £50,270.

Capital gains tax (CGT)

The annual exempt amount for individuals and estates fell to £3,000 in 2024/5. For most trusts, the exemption is now £1,500.

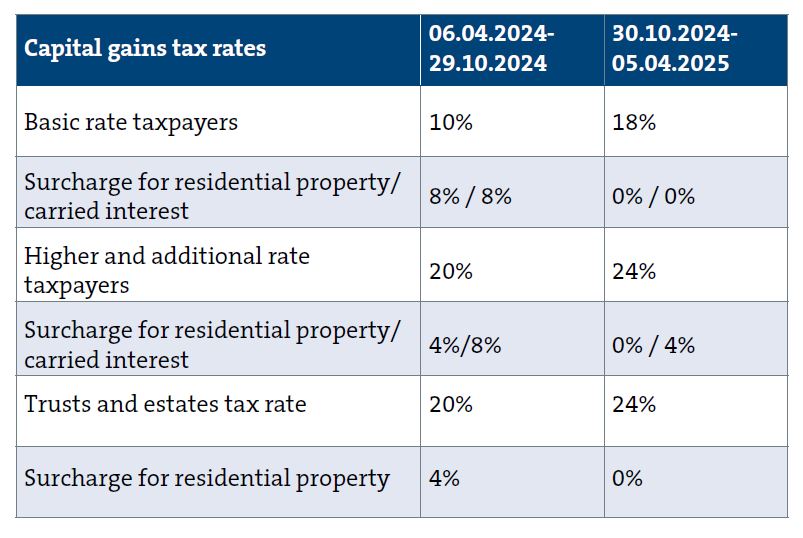

On 30 October, Chancellor Rachel Reeves announced changes to CGT with immediate effect. This means for the 2024/5 tax year, different rates of CGT apply at different times.

The CGT rate for business asset disposal relief is 10% on a lifetime limit of £1,000,000 for trading businesses and companies (minimum 5% participation) held for at least 2 years. This rate is set to rise to 14% from 6 April 2025 and 18% from 6 April 2026. The rate for investors’ relief will also increase to these levels.

Other CGT points to remember in financial planning include:

- Consider a loss claim for assets of negligible value (such as shares in companies that have gone into administration).

- Income tax relief may be available for losses on shares you have subscribed for in unlisted trading companies.

- The deadline to report and pay CGT after selling UK residential property is 60 days after completion.

- Capital losses in one tax year will reduce capital gains of the same year, even if the annual exemption is wasted. They must be claimed within four years of the end of the tax year in which they arose, but any excess not used against gains will be carried forward indefinitely and used against later year gains which exceed the annual exemption.

- Assets can be transferred between spouses/civil partners CGT-free, so ensure you make the best use of both annual exemptions, losses and lower tax rates.

- If you give away certain business assets or make a gift which is immediately chargeable to IHT, you can sometimes claim to hold over the gain for tax purposes.

Inheritance tax (IHT)

The nil rate band will remain at £325,000 until 5 April 2030. The residence nil rate band (RNRB) also stays at £175,000, and the RNRB taper will continue to apply where the value of the deceased’s estate is greater than £2m.

Exemption from IHT on lifetime gifts normally depends on surviving at least seven years, but exceptions exist. You can give up to £3,000 in total each tax year to anyone, plus the amount of any unused allowance from the preceding year.

In addition, you can give up to £250 each to any number of people each year (but they cannot be the same people who received gifts from the £3,000 annual gift allowance). Gifts of assets that grow in value can save IHT – even if you die within seven years – because the growth in value is in the recipient’s estate, not yours.

Individual Savings Accounts (ISAs)

No tax is payable on income or gains on investments within an ISA. You can invest up to £20,000 in total this tax year. The corresponding limit for junior ISAs and child trust funds is £9,000.

Enterprise Investment Scheme (EIS) and other investments

The EIS and the venture capital trust (VCT) scheme have now been extended by 10 years to 5 April 2035.

Non-doms and residency

Can we help?

With many thresholds still frozen in the 2024/25 tax year, it’s important to check income increases don’t tip you into higher tax brackets. Do chat with your Shipleys contact for further guidance and help.

Specific advice should be obtained before taking action, or refraining from taking action, in relation to this summary. If you would like advice or further information, please speak to your usual Shipleys contact.

Copyright © Shipleys LLP 2025