Updated 1 April 2022

In this summary you will find details of:

The Key Announcements

- National Insurance Contributions

- Fuel Duty

- Basic Rate of Tax

- VAT on Energy Saving

- Research & Development Tax Credits

- Green Relief for Business Rates

What Lies Ahead

2022/23 changes (and freezes) already announced

Background

Just before Christmas, the Chancellor asked the Office for Budget Responsibility (OBR) to produce an economic and fiscal forecast for 23 March. The timing and brief nature of the accompanying Treasury announcement reflected Mr Sunak’s wish to keep the Spring Statement a low-profile event.

Recent events including the war in Ukraine and its impact on the cost-of-living pressures, prompted many demands for action. This was not meant to be a March mini-Budget. Tuesday’s public finance figures suggested the Chancellor had £25-30 billion of wiggle room and as a result a number of significant measures have been announced.

THE KEY ANNOUNCEMENTS

The Chancellor announced several changes, including:

National insurance contributions

The primary threshold for Class 1 national insurance contributions (NICs) will increase from £190 a week (£9,880 a year) to £242 a week (£12,570 a year) from 6 July 2022, bringing it in line with the frozen personal allowance.

For company directors, who are subject to special rules, the equivalent annual amount from July will be £11,908.

From 2023/24, all employees will share the same £12,570 annual threshold. The maximum potential Class 1 employee NICs saving in 2022/23 is £269.

For the self-employed, the lower profits limit will increase from £9,880 to £11,908 in 2022/23, rising to £12,570 in 2023/24. Class 2 NICs will not be payable if profits are below these limits. The maximum potential Class 4 NICs saving in 2022/23 is £208.

There is no change to the Class 1 secondary threshold (employer), but the employment allowance will be raised from £4,000 to £5,000 for 2022/23 onwards.

Fuel duty

The rate of fuel duty on petrol and diesel is reduced by 5p a litre for 12 months from 6pm on 23 March.

Basic rate tax

The basic rate of income tax will be reduced to 19% from 2024/25. This cut will apply to the savings basic rate for taxpayers across the UK in relation to savings income. For taxpayers in England, Wales and Northern Ireland the same cut will also apply to non-savings and non-dividend income.

Note, Scotland sets its own basic rate of tax on non-savings, non-dividend income and will receive corresponding funds under the Barnett formula.

VAT on energy saving

Eligibility for VAT relief on energy saving materials will be expanded and the VAT rate reduced to zero for five years from 1 April 2022. These changes do not apply to Northern Ireland.

Research & development (R&D) tax credits

From April 2023, all data and cloud computing costs associated with research and development (R&D) will qualify for R&D relief.

Green relief for business rates

The Autumn 2021 Budget introduced targeted business rates exemptions from 1 April 2023 until 31 March 2035 for eligible plant and machinery used in onsite renewable energy generation and storage, and a 100% relief for eligible low-carbon heat networks with their own rates bill. The implementation of these measures will now take effect from April 2022.

WHAT LIES AHEAD

THE TAX PLAN

The Chancellor announced a ‘Tax Plan’ alongside the Spring Statement, setting a basis for consultation ahead of measures in the Autumn 2022 Budget.

Capital Allowances

The Chancellor announced he wants to reform the tax incentives for investment from April 2023. This is when the 130% super-deduction will end and the main corporation tax rate is due to rise to 25%.

In his Tax Plan he set out examples of changes that may be considered for capital allowances in a forthcoming consultation over the summer. The intention here is that changes would be announced in the Autumn Budget ready for implementation in April 2023. The potential changes could include:

- Increasing the permanent level of the Annual Investment Allowance, possibly to £500,000.

- Increasing Writing Down Allowances for main and special rate assets from the current 18% and 6% levels to 20% and 8%. This would support businesses investing above the Annual Investment Allowance ceiling.

- Introducing a First Year Allowance for main and special rate assets where firms can deduct, for example, 40% and 13% in the first year, with the remaining balance of expenditure obtaining relief in subsequent years at standard Writing Down Allowances rate.

- Introducing an Additional First Year Allowance, to bring the overall amount that can be claimed to greater than 100% of the initial cost. This could bring an additional capital allowance of 20% in the first year, on top of standard Writing Down Allowances on 100% of the initial cost across the first and subsequent years.

- Introducing full expensing, to allow businesses to write off the costs of qualifying investment in one go when incurred. This would simplify the capital allowances regime but it is noted that this would likely cost significantly more than the above options.

It is anticipated that the Government will review these options and seek to consult with businesses over the summer in order to announce changes in the Autumn Budget in time to apply by April 2023. We will be monitoring the outcome of the consultation and reporting on the changes when the position is clearer.

R&D Tax Credits

R&D expenditure in the UK is half the OECD average, but the UK spends more than many other countries on R&D tax relief. The Chancellor plans to reform R&D tax credits, potentially making some R&D expenditure credits more generous.

In 2021 the Chancellor had revealed the government was reviewing the R&D tax relief system, and were keen to ensure it represented value for money for taxpayers. In his 2022 Spring Statement, the Chancellor announced that he is looking to make changes, however, we await further announcements. Potential changes here may include:

- The relief available to companies claiming under the RDEC scheme will be reviewed to assess if it can be made more attractive to companies. The aim here is to encourage more international organisations to invest in R&D in the UK.

- Tackling potential abuse of R&D tax reliefs, particularly from companies claiming under the SME scheme.

Training

In his speech the Chancellor said that he wanted to ‘consider whether the current tax system, including the operation of the apprenticeship levy, is doing enough to incentivise businesses to invest in the right kinds of training’.

Employee Share Schemes

The Government had previously launched a review into the Enterprise Management Incentive (EMI) scheme. In his Tax Plan the Chancellor confirmed that the current EMI scheme will remain effective in its current form. The scope of his review will now consider the alternative tax advantaged share scheme, the Company Share Option Plan (CSOP). The intention here is that the review will look to bridge the existing gap between the benefits gained under an EMI scheme compared to the CSOP.

2022/23 changes (AND FREEZES) already announced

Several tax and other changes (including freezes) will take effect from 6 April 2022. Most of these date back to the two Budgets of 2021. There are further important changes coming down the line.

Income tax: UK

The personal allowance for 2022/23 will remain at £12,570 and the basic rate band will similarly be frozen at £37,700 (outside Scotland), making the higher rate threshold (the sum of the two) an unchanged £50,270.

These freezes, which are set to continue until April 2026, in fact represent a real-terms tax increase, given that the Bank of England forecasts that CPI inflation in April will be 8%.

Dividend tax rates will increase by 1.25 percentage points from 2022/23, taking them to between 8.75% (basic) and 39.35% (additional rate). Both the dividend allowance and the personal savings allowance are unchanged.

Income tax: Scotland

In Scotland a separate set of rates and bands will continue to apply to non-savings, non-dividend income – primarily earnings. The same personal allowance as in the rest of the UK will continue to apply in Scotland.

Scottish taxpayers will still have five tax bands, with the tax rates for 2022/23 ranging from 19% to 46%. The threshold for the higher rate of income tax (at 41%, rather than 40%) will remain unchanged at £43,662, which is £6,608 below the rest of the UK. Someone with earnings of £50,000 a year will have an extra income tax charge of £1,489 a year for being resident north of the border.

Income tax: Wales

The National Assembly for Wales decided not to make any changes from the rates of the rest of the UK (excluding Scotland).

National insurance contributions

The secondary threshold for employer’s Class 1 NICs will increase by 3.3%, approximately in line with inflation to September 2021. The upper earnings limit (for employees) and upper profits limit (for the self-employed) will be frozen at £50,270, matching the unchanged UK higher rate income tax threshold outside Scotland.

The Class 2 NIC rate for 2022/23 will be £3.15 per week.

The rates for all contributions under Class 1 (employed) and Class 4 (self-employed) will rise by 1.25 percentage points for 2022/23 only, before dropping back to 2021/22 levels after that. The separate 1.25% Health and Social Security Levy will then take effect from 6 April 2023. Unlike the position with NICs, employees and the self-employed over state pension age (currently 66) will be subject to the new levy.

Automatic pension enrolment

The contribution levels for workplace pensions operating under the automatic enrolment provisions for 2022/23 will be unchanged:

| 2021/22 and 2022/23 | |

| Earnings trigger for auto-enrolment | £10,000 |

| Employer minimum contribution | 3% of band earnings £6,240 – £50,270 |

| Employee contribution* | 5% of band earnings £6,240 – £50,270 |

| Total minimum contribution | 8% of band earnings £6,240 – £50,270 |

| Maximum potential total contribution | £3,522 |

* Assuming employer pays minimum required by law

Pensions – the lifetime and annual allowances

The lifetime allowance, which sets the effective maximum tax-efficient value of pension benefits, will remain at £1,073,100 for 2022/23 and is not due to rise until 2026/27. There is also no increase to the annual allowance, which remains at a maximum of £40,000, subject to the taper and money purchase annual allowance rules.

Company cars

Company car tax for vehicles registered since 6 April 2020 will rise in 2022/23 for all but the highest emission vehicles.

- The taxable cash equivalent percentages will all increase by one percentage point, subject to the current ceiling of 37% of list price.

- Older cars will be unaffected, meaning that in 2022/23 the same scale will apply to cars with CO2 emissions measured under both the NEDC and the newer WLTP yardsticks.

The diesel surcharge will remain at 4% for diesel cars that do not meet the RDE2 emission standard (which became mandatory from January 2021). The maximum charge for diesels also stays at 37%.

The scale charge for purely electric vehicles (EVs) will double to 2%, but EVs remain an attractive option for anyone able to obtain such a vehicle under salary sacrifice arrangements.

Inheritance tax (IHT)

The residence nil rate band and main nil rate band will remain at £175,000 and £325,000. Both are set to stay frozen until 2026/27.

Value added tax

The reduced 12.5% VAT rate for hospitality, holiday accommodation and attractions will end on 31 March 2022, at which point the rate will revert to the 20% standard rate.

Student finance

For our clients and contacts with children looking to progress to Higher Education, in January and February the government announced new rules for student finance applying to students in England and Wales.

For existing Plan 2 student loan borrowers (those who started a course on or after 1 September 2012) and those starting courses in the 2022/23 academic year, the repayment threshold will be frozen at £27,295 up to and including 2024/25, before increasing annually in line with RPI thereafter.

For new students commencing study from the 2023/24 academic year:

- the maximum rate of interest during and after study will be cut to RPI+0%;

- the repayment term will be extended from 30 years to 40 years; and

- the repayment threshold will be reduced to £25,000 and frozen at that level before increasing annually with RPI from 2027/28.

The mechanism by which the Treasury accounts for these changes will produce an £11.15 billion windfall in 2022/23.

Summary

The Spring Statement was not meant to be a March mini-Budget, despite what many headlines in the days before suggested. Instead, on the day the inflation rate was announced as having reached 6.2%, the Chancellor announced a range of tax cuts aimed at countering the cost of living crisis.

At the end of his speech, in an unusual pre-Budget unveiling of a specific tax move, the Chancellor announced that the basic rate of income tax will be cut from 20% to 19% from April 2024 for taxpayers in England, Wales and Northern Ireland.

As we usually say after a Chancellor’s announement, the devil is in the detail. As the Treasury begins to release the papers behind the Chancellor’s headlines, we will be closely monitoring what these mean for our clients. We’ll be sharing our conclusions and advice here on our website and in our conversations with clients.

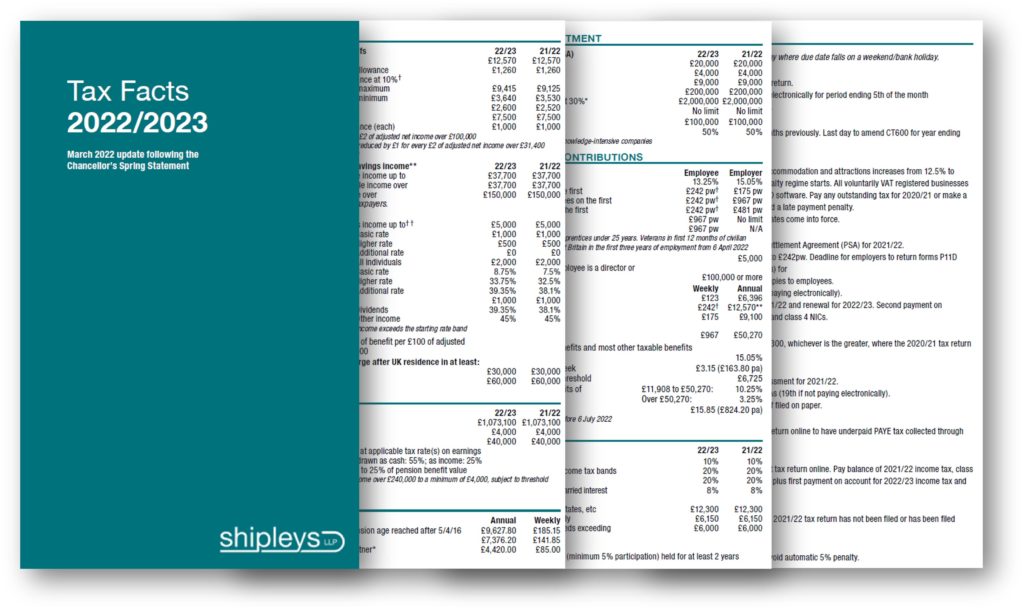

We have also upaded the digital version of our 2022/23 Tax Facts cards, to give all the latest rates and key dates.

Download: Tax Facts 2022/2023 March 2022 update

In the meantime, if you wish to discuss how the Spring Statement will impact on you, please do talk with your usual Shipleys’ contact or one of our offices.

Note

This summary is based on the Chancellor’s Spring Statement on 23 March 2022, supplemented by information from official publications.

It reflects our understanding of proposed changes to tax law and practice at the date of publication, but is not a complete and definitive guide. The Government’s proposals may be amended.

Specific advice should therefore be obtained before taking action, or refraining from taking action, on the basis of this information.

© 2022 Shipleys LLP