Introduction

Chancellor Jeremy Hunt’s statement was in two parts: firstly, a pre-emptive media statement in the morning, then an official statement to the House of Commons in the afternoon. This revoked many of the key measures in former Chancellor Kwasi Kwarteng’s ‘fiscal event’ of 23 September.

In this overview

Measures revoked

- Income Tax Changes

- Corporation Tax Changes

- Off-payroll Working

- Dividend Tax

- VAT-free Shopping

- Alcohol Duty

Under Review – The Energy Price Guarantee

Measures Retained

- National Insurance Contributions

- Stamp Duty Land Tax

- Annual Investment Allowance

- Seed Enterprise Investment Scheme

Financing

Measures revoked

Income tax

The cut to 19% in the basic rate of tax (outside Scotland) from 2023/24 will not take place. Instead, basic rate will remain at 20% “indefinitely”, meaning that even Rishi Sunak’s 2024/25 scheduled timing has been dropped.

The Chancellor also confirmed that the changes to the additional rate of income tax, which his predecessor had proposed and then revoked on 3 October would still not go ahead. The additional rate of income tax would remain in place.

Corporation Tax

On 14 October the Government had announced that the originally proposed reduction to Corporation Tax in Kwasi Kwarteng’s September statement, was to be scrapped.

Corporation Tax will still increase to 25% from April 2023. The previously announced small profits rate of Corporation Tax will be maintained. This means smaller or less profitable businesses will not pay the full 25% rate, and companies with less than £50,000 of profit will not see any increase at all, continuing to pay Corporation Tax at 19%.

In his statement on 17 October Chancellor Jeremy Hunt reiterated the Corporation Tax reduction would not take place.

Off-payroll working rules

The off payroll working rules in the public and private sectors (often referred to as IR35) will remain in place. This reverses their previously proposed removal for the start of the next tax year.

Dividend tax rates

The 1.25 percentage points reduction in dividend tax rates, due from 2023/24, will be scrapped.

VAT-free shopping

The proposed VAT-free shopping for overseas visitors will now not be re-introduced.

Alcohol duty

There will now be no freeze on alcohol duty for one year from February 2023.

Under review

The Energy Price Guarantee (EPG), which was due to cap average domestic bills at £2,500 a year for two years from the start of October, will now be scaled back to last only until April 2023.

In the meantime, the Treasury will design “a new approach that will cost the taxpayer significantly less than planned whilst ensuring enough support for those in need”. Any support for businesses from April 2023 “will be targeted to those most affected”.

Measures retained

National Insurance Contributions

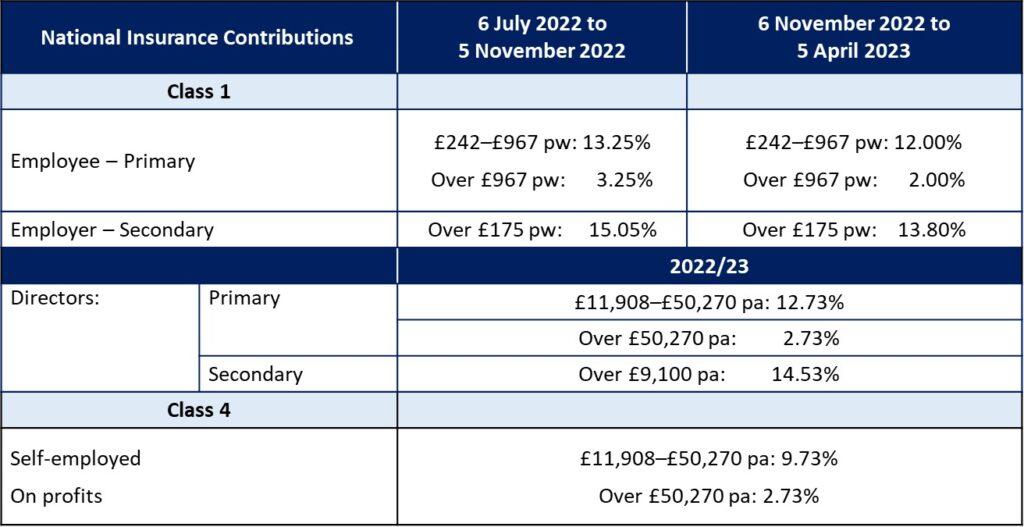

The reduction in national insurance contributions, which reached its third reading in the House of Lords on 17 October, will go ahead. This means the additional 1.25 percentage points previously added to all 2022/23 Class 1 and Class 4 NIC rates will be scrapped with the change due to take effect from 6 November 2022.

The 1.25% health and social care levy, due to replace the NICs increase from 2023/24, will be abandoned. There is no change to the increased 2022/23 Class 1 primary threshold and Class 4 lower profits threshold announced in the Spring Statement 2022. The rates and thresholds for the rest of the 2022/23 tax year for those affected are as follows:

Stamp Duty

The stamp duty land tax cuts that took effect on 23 September will not be reversed. This means that the 0% band threshold for stamp duty land tax (SDLT) rates for residential property remains at £250,000.

The relief for first-time buyers introduced in the September statement which raised the 0% band threshold from £300,000 to £425,000 and the maximum value of property on which they can claim the relief from £500,000 to £625,000, also remain.

Note, these changes only affect England and Northern Ireland. The Scottish Government has announced that it will set out its plans for land and buildings transaction tax as part of the normal budget process and the Welsh Government has given no information about its land transaction tax.

Annual investment allowance and Seed Enterprise Investment

The extension of the £1 million annual investment allowance beyond March 2023 remains, as do enhancements to the seed enterprise investment scheme (SEIS) and company share option plans.

With the latter, from April 2023, companies will still be able to raise up to £250,000 of seed enterprise investment scheme (SEIS) investment – a £100,000 increase on the current limit. At the same time:

- the gross asset limit will be increased to £350,000;

- the company age limit will be raised from two to three years; and

- the annual investor limit will double to £200,000.

The SEIS, enterprise investment scheme (EIS) and venture capital trust (VCT) scheme will continue to be extended beyond 2025.

Financing

The measures which Chancellor Jeremy Hunt unwound account for about £11 billion of the extra £45 bn of borrowing by 2026/27 created by the 23 September ‘fiscal event’.

The U-turn on abolishing the top 45% rate of tax (outside Scotland) and the 14th October’s decision to keep the already legislated for corporation tax increases were worth about £21 bn, implying that over 70% of Kwasi Kwarteng’s planned borrowing spree had now disappeared.

Based on recent analysis by the Institute for Fiscal Studies, the 2026/27 financing black hole that remains after all the unwinding is about £32 bn, although press rumours at the weekend suggested that the Office for Budget Responsibility (OBR) could add another £10 bn to the IFS’s debt projection.

Summary

The Chancellor stated that there will be “more difficult decisions” to come on both tax and spending. Government departments will be asked to find efficiencies within their budgets. In his initial statement Mr Hunt also said, “Some areas of spending will need to be cut.”

Further changes to fiscal policy to put the public finances on a sustainable footing will be announced on 31 October alongside the publication of the OBR’s Economic and Fiscal Outlook.

As we usually say after a Chancellor’s announcement, the devil is in the detail. Over the coming days The Treasury will release the papers behind the Chancellor’s headlines and we will be closely monitoring what these mean for our clients.

Given Market reaction, and potential further increases in interest rates, we will be following all the developments and sharing our conclusions and advice here on our website and in our conversations with clients.

Can we help?

In the meantime, if you wish to discuss how the new Chancellor’s Statement will impact you, please do talk with your usual Shipleys’ contact or one of our offices.

Note

This summary is based on the Chancellor’s Statements on 17 October 2022 and supplemented by information from official publications. It reflects our understanding of proposed changes to tax law and practice at the date of publication, but is not a complete and definitive guide. The Government’s proposals may be amended.

Specific advice should therefore be obtained before taking action, or refraining from taking action, on the basis of this information.

© 2022 Shipleys LLP