IN THIS SUMMARY YOU WILL FIND DETAILS OF:

The highlights from the Statement

Personal Tax

Business Taxes

Changes retained from the 23 September Fiscal Statement

Economic Overview

Highlights from the Statement

- The main income tax allowances and thresholds, the main national insurance thresholds plus the inheritance tax nil rate bands will be frozen at their current levels for an extra two years to April 2028.

- The threshold for the 45% additional rate of income tax will reduce from £150,000 to £125,140 from April 2023.

- The dividend allowance will reduce from £2,000 to £1,000 from April 2023 and be halved again to £500 from April 2024. The capital gains tax annual exempt amount will be cut from £12,300 to £6,000 for 2023/24 and halved to £3,000 for 2024/5.

- The government’s energy price guarantee will be adjusted from April 2023 so that the typical household will pay £3,000 a year.

- The state pension, pension credit, universal credit (UC), the benefit cap and certain other benefits will increase by 10.1% in line with CPI inflation to September 2022.

- Business rates bills in England will be updated from April 2023 to reflect April 2021 property values and there will be a £13.6 billion package of targeted support for businesses over the next five years.

- Research and development tax reliefs will be reformed with respect to expenditure incurred from 1 April 2023. The windfall profits of oil and gas companies will be subject to further tax increases and a new levy will apply to the ‘extraordinary returns’ of low-carbon electricity generators

Introduction

Chancellor, Jeremy Hunt, was faced with a challenging economic backdrop to his first major set piece, grappling with a combination of over 11% inflation, an official recession and the need to calm markets and re-establish the UK’s financial credibility following the turmoil of September’s Fiscal Statement.

In his statement on 17 November just under half of the £55 billion consolidation came from tax and the balance from spending. Mr Hunt described his strategy as a balanced plan for stability, following two broad principles: asking those with more to contribute more; and avoiding tax rises that most damage growth. Nevertheless, the tax increases announced are substantial, according to Mr Hunt, with tax as a percentage of GDP increasing by 1% over the next five years.

The Chancellor said he aimed to deliver a plan to tackle the cost of living crisis and rebuild the economy with stability, growth and public services as the priorities.

Personal Tax

- Income Tax

- Dividend Tax

- National Insurance Contributions (NICS)

- Capital Gains Tax

- Inheritance Tax

- Stamp Duty Land Tax

- Enveloped Dwellings (ATED)

- Company Cars

- Electric Vehicles

- Fuel Duty

- State Pensions and Security Benefits

- Energy Price Support

- Social Care Funding in England

- Council Tax in England

Income tax

The personal allowance will remain at £12,570 for an extra two tax years until 5 April 2028 and the higher rate threshold will stay at £50,270, the levels that first took effect in 2021/22.

From 2023/24, the 45% additional rate threshold will be reduced from £150,000 (the level set in 2010/11) to £125,140. In Scotland, the higher and top (additional) rate thresholds for non-savings, non-dividend income will be announced in the Scottish Budget on 15 December.

The blind person’s allowance will be increased to £2,870 for 2023/24.

Dividend tax

The dividend allowance will be halved to £1,000 for 2023/24 and halved again in 2024/25 to £500.

National insurance contributions (NICs)

The class 1 primary threshold and class 2 lower profits limit will remain aligned with the personal allowance (£12,570) until April 2028.

The upper earnings limit and class 4 upper profits limit will remain aligned to the higher rate threshold at £50,270 through to April 2028. The lower earnings limit (£6,396) and the small profits threshold (£6,725) will remain unchanged in 2023/24.

For 2023/24, the class 2 rate will be £3.45 a week and the voluntary class 3 rate will be £17.45 a week.

Capital gains tax

In 2023/24, the annual exempt amount for individuals and personal representatives will be reduced to £6,000 and then halved to £3,000 in 2024/25. The annual exempt amount for most trusts will be cut to £3,000 (minimum £600) in 2023/24 and then halved in the following year.

Inheritance tax

The nil rate band for 2026/27 to 2027/28 will remain at £325,000, which was the level first set for 2009/10. The residence nil rate band (RNRB) will likewise stay at £175,000 and the RNRB taper will continue to apply where the value of the deceased’s estate is greater than £2 million.

Stamp duty land tax (SDLT)

The SDLT cuts affecting residential property in England and Northern Ireland, which were introduced in the Fiscal Statement on 23 September 2022, will be reversed from 1 April 2025.

Enveloped dwellings (ATED)

The annual chargeable amounts for the ATED will be increased by 10.1% for 2023/24.

Company cars and vans

The benefit-in-kind (BIK) appropriate percentages for electric and ultra-low emission cars will increase by one percentage point each year from 2025/26 to 2027/28 up to a maximum appropriate percentage of 5% for electric cars and 21% for ultra-low emission cars.

The BIK rates for all other vehicle bands will be increased by one percentage point for 2025/26 up to a maximum appropriate percentage of 37% and will then be fixed in 2026/27 and 2027/28.

For 2023/24 car and van fuel benefit charges and the van benefit charge will increase in line with CPI.

Electric vehicles

Electric cars and vans will become subject to vehicle excise duty (road tax) from 1 April 2025.

Fuel duty

While no comment was made on fuel duty by the Chancellor in the statement, the OBR did flag up that if the temporary 5p a litre reduction for 2022/23 is not rolled over into 2023/24 and, for once, automatic fuel duty indexation is allowed to take effect, then there will be a total duty rise of around 12p a litre.

State pensions and social security benefits

All UK-wide benefits, including state pensions (under the ‘triple lock’) and the standard minimum income guarantee in pension credit will increase by 10.1% from April 2023. Plans to create a new housing element of pension credit to replace pensioner housing benefit are now intended to take effect in 2028/29.

The benefit cap will be raised from £20,000 to £22,020 for families nationally and from £23,000 to £25,323 in Greater London. For single adults, the national cap will increase from £13,400 to £14,753 and the cap in Greater London will rise from £15,410 to £16,967.

Households on means-tested benefits will receive an additional £900 cost of living payment in 2023/24. Pensioner households will receive an extra £300 cost of living payment, and individuals on disability benefits will get an extra £150 disability cost of living payment.

UC claimants will be able to apply for a loan to help with mortgage interest repayments after three months, instead of the current nine months. The zero earnings rule will be abolished in Spring 2023 to allow claimants to continue receiving support while they are in work and on UC.

Energy price support

The domestic energy price guarantee (EPG) will increase to £3,000 for one year from 1 April 2023 and equivalent support will continue to be provided in Northern Ireland. However, the parameters of the EPG scheme may be revised.

The support for households that use alternative fuels, such as heating oil, to heat their homes will be doubled to £200 for 2022/23.

Social care funding in England

The implementation of the plans to reform the funding of social care in England, recently legislated for in the Health and Care Act 2022, will be deferred for two years until October 2025.

Council tax in England

Local authorities in England will be able to increase council tax by up to 3% a year from April 2023 without needing to hold a referendum. Authorities with social care responsibilities will also be able to increase the adult social care precept by up to 2% a year.

Business Taxes

- Employer National Insurance Contributions (NICs)

- VAT

- Business Rates

- Online Sales Tax (OST)

- Energy bill relief scheme (EBRS)

- Research and Development (R&D) Tax Reliefs

- Creative Industry Tax Reliefs

- National Living Wage (NLW) and National Minimum Wage (NMW)

- First-year Allowance for Electrical Vehicle Charge Points

- Investment Zones

- Tariff Suspensions

- EU Regulations

- Solvency II

- Bank Corporation Tax (CT) Surcharge

- Diverted Profits Tax

- Transfer Pricing

- Windfall Tax

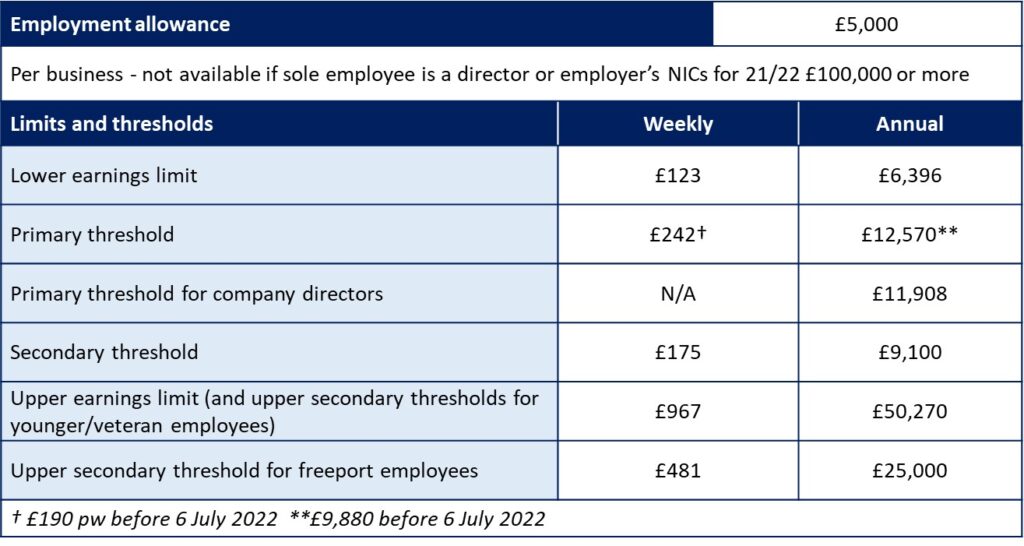

Employer National Insurance Contributions (NICs)

The level at which employers start to pay employer NICs for their employees will remain at the current £9,100 until April 2028. The employment allowance will stay at £5,000.

Value added tax (VAT)

The VAT registration and deregistration thresholds will stay at their current levels of £85,000 and £83,000 respectively.

Business rates

Business rate bills in England will be updated from 1 April 2023 to reflect property values on 1 April 2021. Transitional relief over the next five years will support businesses as they move to their new bills.

Business rates multipliers will be frozen in 2023/24 at 49.9p and 51.2p, avoiding potential increases to 52.9p and 54.2p.

Support for eligible retail, hospitality and leisure businesses will be extended and increased from 50% to 75% business rates relief up to £110,000 per business in 2023/24.

Increases in the bills will be capped at £600 a year from 1 April 2023 for the smallest businesses that lose eligibility or see reductions in the supporting small business scheme or rural rate relief.

The improvement relief announced in the Autumn Budget 2021 will now be introduced from April 2024 and will be available until 2028. The relief is aimed at ensuring that ratepayers do not see an increase in their rates for 12 months as a result of making qualifying improvements to a property they occupy.

Online sales tax (OST)

Following consultation, the government has decided not to introduce an OST, an idea put forward as an equivalent to business rates for online businesses.

Energy bill relief scheme (EBRS)

The government’s review of the EBRS, which offers support to non-domestic energy consumers currently up to March 2023, will be published by 31 December 2022. The government recognises that some businesses may need support beyond March 2023, but such support will be significantly lower and targeted.

Research and development (R&D) tax reliefs

For R&D expenditure after 31 March 2023:

- the R&D expenditure credit rate will increase from 13% to 20%;

- the small and medium-sized enterprises (SME) additional deduction will decrease from 130% to 86%; and

- the SME credit rate will decrease from 14.5% to 10%.

As announced in the Autumn Budget 2021, qualifying expenditure will be expanded to include data and cloud costs and support will be focused on innovation in the UK. The government will consult on the design of a single R&D tax relief scheme for all businesses.

Creative industry tax reliefs

The government will consult on proposals to incentivise further the production of culturally British content and to support the growth of the audio-visual sectors.

National living wage (NLW) and national minimum wage (NMW)

The government has accepted the recommendation of the Low Pay Commission to increase the NLW for individuals aged 23 and over by 9.7% to £10.42 an hour from 1 April 2023. NMW rates for younger workers and apprentices will be increased by similar percentages.

First-year allowance for electric vehicle charge points

The 100% first-year allowance for electric vehicle charge points will be extended to 31 March 2025 for corporation tax and 5 April 2025 for income tax.

Tax conditionality: licensing in Scotland and Northern Ireland

The requirement to make the renewal of certain licences in Scotland and Northern Ireland conditional on applicants completing checks to confirm they are appropriately registered for tax will now come into force for licence renewals from October 2023 rather than April 2023.

Investment zones

The government will refocus the investment zones programme to create a limited number of high potential clusters, working with local stakeholders, to be announced in the coming months. Existing expressions of interest will not be taken forward.

Tariff suspensions

Tariffs on over 100 imported goods will be removed for two years to help reduce costs for UK producers.

EU regulations

By the end of next year, the government will decide and announce changes to EU regulations in the UK’s growth industries: digital technology, life sciences, green industries, financial services and advanced manufacturing.

Solvency II

In its consultation response the government said it would introduce a “simpler, clearer and much more tailored regime”. The required risk margin would be reduced significantly, with a 65% cut for long term life insurance business.

Bank corporation tax (CT) surcharge

The proposed changes to the bank CT surcharge will go ahead, following the decision to proceed with the CT main rate increase to 25% from April 2023. This means that banks will be charged an additional 3% on their profits above £100 million.

Diverted profits tax

The rate of diverted profits tax (on profits diverted out of the UK) will increase from 25% to 31% from April 2023, maintaining a six percentage points differential above CT.

Transfer pricing

Large multinational businesses operating in the UK will have to keep and retain transfer pricing documentation in a prescribed and standardised format set out by the OECD. This will help HMRC identify risks and conduct transfer pricing investigations more efficiently.

Windfall taxes

The energy profits levy will rise from 25% to 35% from 1 January 2023. The investment allowance will be reduced to 29% for all investment expenditure other than on decarbonisation. A temporary electricity generator levy of 45% will be charged on ‘extraordinary returns’ from low-carbon UK electricity generation.

Changes retained from the 23 September Fiscal Statement

- National Insurance Contributions

- Stamp Duties

- Annual Investment Allowance

- Company Share Option Plan (CSOP)

- Venture Capital Schemes

- Office of Tax Simplification

Many of the proposals that emerged in Kwasi Kwarteng’s Fiscal Statement on 23 September 2022 have been reversed. However, some remain. The more notable surviving changes are:

National insurance contributions

The 1.25 percentage points increases to all 2022/23 class 1 and class 4 NIC rates initially introduced by Rishi Sunak as Chancellor were scrapped with effect from 6 November 2022. The revised rates are shown below.

* No employer NICs on the first £967pw for employees generally under 21 years, apprentices under 25 years and veterans in first 12 months of civilian employment. No employer NICs on the first £481pw for employees at freeports in Great Britain in the first three years of employment starting from 6 April 2022.

The 1.25% health and social care levy, which was due to replace the NIC increase from 2023/24, was also abandoned.

Stamp duties

From 23 September 2022, SDLT rates for residential property were revised, increasing the 0% band threshold from £125,000 to £250,000.

The government also increased relief for first-time buyers, raising the 0% band threshold from £300,000 to £425,000 and the maximum value of property on which they can claim the relief from £500,000 to £625,000. These changes only affect England and Northern Ireland.

The Welsh government has revised some of its land transaction tax (LTT) residential rates. From 10 October 2022, the starting threshold for paying main residential rates of LTT increased from £180,000 to £225,000. The first tax band will cover transactions from £225,000 to £400,000 and be taxed at 6%. The tax rates and bands for properties over £400,000 and for additional residential and all corporate residential properties are unchanged.

The Scottish Government has announced that it will set out its plans for land and buildings transaction tax (LBTT) in its Budget on 15 December.

Annual investment allowance

The current £1 million level of the annual investment allowance was made permanent.

Company share option plan (CSOP)

From April 2023, qualifying companies will be able to issue up to £60,000 of CSOP options to employees, doubling the current limit. The ‘worth having’ restriction on share classes within the CSOP will be eased, better aligning the scheme rules with the rules in the enterprise management incentive (EMI) scheme and widening access to CSOP for growth companies.

Venture capital schemes

From April 2023, companies will be able to raise up to £250,000 of seed enterprise investment scheme (SEIS) investment – a £100,000 increase on the current limit. At the same time: the gross asset limit will be increased to £350,000; the company age limit will be raised from two to three years; and the annual investor limit will double to £200,000.

The Seed Enterprise Investment Scheme (SEIS), Enterprise Investment Scheme (EIS) and Venture Capital Trust (VCT) scheme will be extended beyond 2025.

Office of Tax Simplification

The Office of Tax Simplification (OTS) will be abolished, to be replaced with a mandate to the Treasury and HMRC to focus on simplifying the tax code.

Economic Overview

The economic backdrop to the Autumn Statement was a challenging one, with the Chancellor confronted by a combination of over 11% inflation, recession and the need to re-establish the UK’s financial credibility. The question remains, however, whether the UK economy will fulfil the relatively optimistic growth forecasts now implicit in the projections of the Office for Budget Responsibility (OBR).

The first Economic and Fiscal Outlook (EFO) of 2022 from the OBR was published on 23 March, shortly after the invasion of Ukraine. Three prime ministers, four chancellors and nearly nine months on from the beginning of Mr Putin’s ‘special military operation’, the UK’s (and much of the world’s) economic prospects have changed significantly:

- The new OBR forecast says inflation will be 9.1% in 2022, 7.4% in 2023 and just 0.6% in 2024. Inflation is a two-edged sword for the Treasury. On one positive side it has increased the extra revenue raised by the many tax allowance freezes announced in March 2021 from the original estimate of £8 billion to £30 billion now. On the negative side it has made spending cuts more difficult for the Treasury because last year’s Spending Review set departmental budgets in cash terms, based on the low forecasts for inflation.

- The outlook for economic growth in the short term is much lower. The OBR projected growth is −1.4% in 2023, 1.3% in 2024 and 2.6% in 2025, echoing the Bank of England’s recent forecast for a recessionary 2023.

- Interest rates have risen faster than the OBR expected in the Spring in response to the double-digit inflation, with rates averaging more than 4% through to the end of 2025/26.

- The combination of higher inflation, poor growth and rising interest rates was destined to hit government borrowing even before the huge costs of energy price support were added to the mix. For 2022/23, government borrowing is projected to be £177 billion, £78 billion above the level the OBR projected in March. In the coming financial year, borrowing will only come down to £140 billion – £90 billion above the March 2022 forecast.

Summary

This Autumn Statement came against the background of a European recession and high inflation in the wake of the pandemic and the war in Ukraine. It also sought to restore confidence in the UK’s financial position after recent weeks of turmoil.

In doing so, Mr Hunt’s position was not an enviable one. His long-term focus, he stated, is on stability, growth and public services. Most of the attention, however, centres on the balance he attempted to strike between tax increases (real and stealth) and spending cuts to fill the over £50 billion hole he has inherited.

With a full Budget still likely in the Spring, there is much to inform people’s tax and financial planning for the remainder of the current tax year.

As we usually say after a Chancellor’s announement, the devil is in the detail. As the Treasury begins to release the papers behind the Chancellor’s headlines, we will be closely monitoring what these mean for our clients. We’ll be sharing our conclusions and advice here on our website and in our conversations with clients.

We have also updated our Tax Facts Guide for the 2022/23 tax year to reflect the changes in this Fiscal Statement.

Download: Tax Facts 2022/23 – November 2022 Update

Can we help?

In the meantime, if you wish to discuss how The Chancellor’s Statement will impact you, please do talk with your usual Shipleys’ contact or one of our offices.

Note

This summary is based on the Chancellor’s Statement on 17 November 2022 and supplemented by information from official publications. It reflects our understanding of proposed changes to tax law and practice at the date of publication, but is not a complete and definitive guide. The Government’s proposals may be amended.

Specific advice should therefore be obtained before taking action, or refraining from taking action, on the basis of this information.

© 2022 Shipleys LLP